How To Prepare For A Rates Of Interest Increase

A realty agent may try to get you to buy a bit more, but you can locate on your own in worse economic form if you stretch your spending plan to make room for a larger mortgage. The Federal Get has an instead big required, balancing work with rising cost of living as well as interest rates. Furthermore, these concerns are commonly much more interrelated than you think, so the accomplishment of an objective in one area can affect all the others. A little bit of rising cost of living boosts the economic situation by encouraging individuals to purchase items and also services now.

- Here's what the Fed does, why it matters for the home loan price market, and why you should not always allow it influence your plans to purchase or refinance next year.

- As rate of interest has a big effect on your home mortgage repayments, it's essential to comprehend ...

- This might influence which products we review as well as cover, yet it in no chance influences our referrals or advice, which are grounded in countless hrs of research.

- If you find inconsistencies with your credit score or information from your credit report, please get in touch with TransUnion ® directly.

- While the Federal Book claimed Wednesday that interest rates will stay near absolutely no in the meantime, the quick tapering of bond purchases is seen as the first step en route to interest-rate walks next year.

Bank Card & Loans Eligibility Calculator Reveals which top cards and financings you're most likely to obtain. MoneySavingExpert.com becomes part of the Moneysupermarket Team, but is totally editorially independent. Its position of placing consumers initially is safeguarded and preserved in the legally binding MSE Content Code. This information does not constitute economic guidance, always do your own research on the top to guarantee it's right for your particular scenarios and also remember we focus on prices not solution. If dealing with again, consider that if rate of interest were to continue rising, it could be sensible not to repair for also lengthy so you can maintain taking advantage of higher rates.

Discover more about rate of interest types and afterwards use our Explore Passion Rates tool to see exactly how this option influences rates of interest. Different lending institutions can offer different financing products and also prices. Despite whether you are wanting to get in a country or metropolitan location, speaking with several loan providers will aid you understand every one of the alternatives offered to you. Prior to you start home mortgage buying, your initial step needs to be to check your debt, as well as assess your credit scores reports for errors.

This, in turn, can influence the cost of borrowing or the rate of interest charged when financial institutions, such as banks, provide money. Home loan prices continue to be historically low, so individuals will certainly still have the ability to obtain large amounts. Further price rises and/or sustained high rising cost of living will certainly have an effect however, as longer as lenders' price checks continue to be in position. There's usually a correlation in between home mortgage rates and the Fed funds rate, however it does not relocate lockstep with a longer-term car loan like a home mortgage similarly it could with variable-rate charge card. There can also be times where home mortgage rates move in the opposite instructions for a brief period of time.

Youre Our First Priority Whenever

" Banks have actually been notoriously slow-moving to boost what depositors can earn on their accounts," Ma included. Better, when the Fed does raise it benchmark rate, down payment prices are much slower to respond, and also even then, just incrementally. Cards supplying 15, 18 as well as even 21 months without any interest on transferred balances are "absolutely worth thinking about for any individual who is deep in debt." Fortunately right here is that there are still plenty of zero-percent equilibrium transfer uses available, Schulz claimed.

Exactly How The Federal Get Affects Home Loan Prices

However, despite the fact that a modest surge might not make a big distinction, it's still an action in the best instructions. Usually an SVR is a much higher rate than you can obtain if you remortgaged (although in the present reduced interest-rate environment, SVR rates have actually been rather reduced). If you get on a variable or tracker mortgage-- where what you pay is connected to the base rate-- rate increases mean your home loan ending up being more expensive. The most recent 0.25% increase indicates approximately ₤ 200 a year a lot more per ₤ 100,000 of superior home loan. When, and if, your home loan payments are affected by a rates of interest adjustment will depend onwhat kind of home loan you haveand when your existing offer ends. Rates for fixed home mortgages are influenced by other variables, such as supply and also demand.

Forecasting Modifications

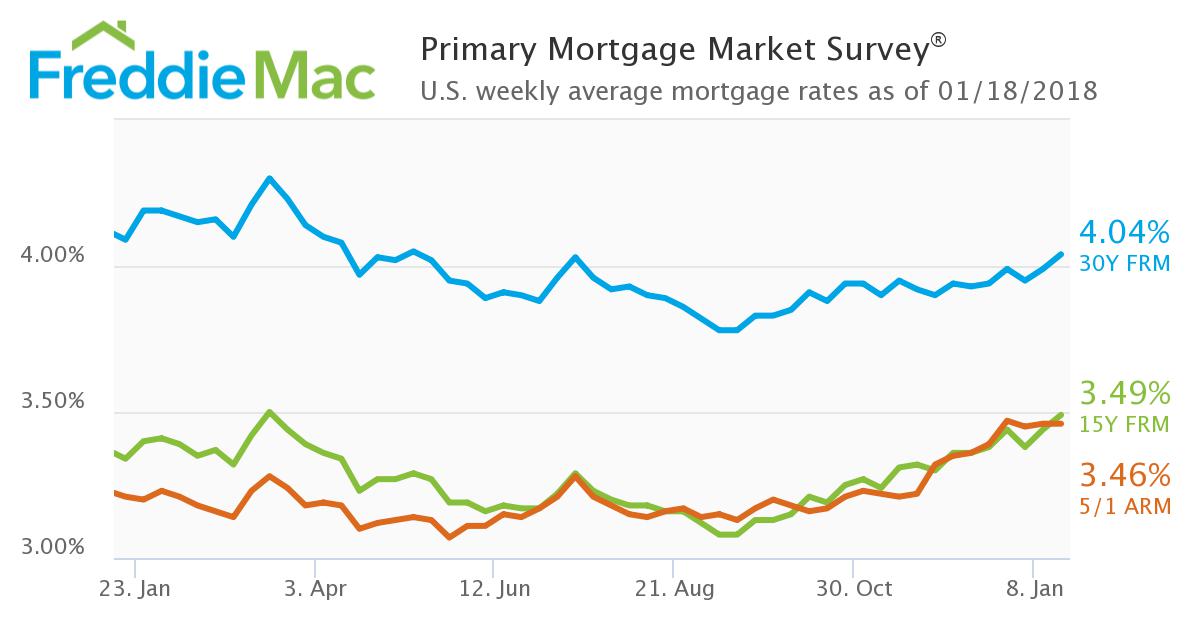

The rates of interest charged by banks is identified by a variety of variables, such as the state of the economic situation. A nation's central bank establishes the rate of interest, which each bank uses to establish the range of interest rate they is buying a timeshare worth it supply. Federal Get Chairman Jerome Powell announced Wednesday the Fed will certainly slow down its bond buying program to fight inflation. These plan adjustments are anticipated to create rising mortgage rates next year. As you check out prospective rate of interest, you may discover that you can be offered a slightly reduced interest rate with a down payment just under 20 percent, compared with one of 20 percent or greater.

With a variable rate home mortgage, your rates of interest might rise or down from month to month, implying the quantity you pay off goes through transform. Yet in unsure financial times, your payments may differ as the rate adjustments, so it's worth thinking about whether price modifications are expected in the future. If you have a tracker home loan, an adjustment in the base price will have a considerable effect on your monthly repayments. Consumers part-way via a fixed price bargain will not be influenced by a rates of interest rise up until the offer finishes, when they will certainly revert onto their lending institution's particular SVR. With a variable financing, you can make extra payments as you want, whereas a taken care of mortgage needs a charge. By being successful of your home loan and paying a larger round figure when rates of interest rise, you will minimize the amount of passion that is charged by reflecting it against a reduced funding balance.

Motivating individuals to save should slow the boost in costs of everyday products. With less purchasers out there, sellers will certainly discover it hard to put their prices up. People are obtaining pennies in passion for every ₤ 100 they keep in financial savings for a year. Some loan providers have actually currently begun to raise wesley timeshare cancellation href="http://elliotonlq372.wpsuo.com/adjustable-rate-home-loan">how to get out of a time share rates for those applying for a brand-new home loan.